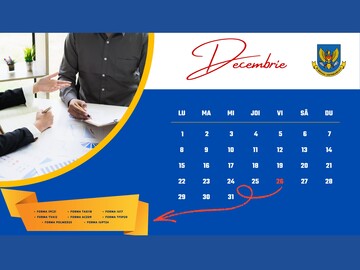

The deadline for filing tax returns and paying taxes and contributions for November is December 26

The State Tax Service has published a tax calendar for December, which contains the deadlines for paying taxes and filing returns. The agency noted that December 26 is the deadline for filing tax returns and paying taxes, fees, mandatory health insurance contributions, and social insurance contributions for November. By this date, it is necessary to submit tax forms for income tax - IPC21, IU17, VAT and excise duty forms TVA12, ACZ09, environmental pollution tax form POLMED25 (for entities that are not part of a collective or individual extended producer responsibility system), and population support fund tax form TFSP20. In addition, November 26 is the deadline for submitting applications for the use of distillates obtained from wine, as well as the deadline for paying property tax for the current year and income tax for the fourth quarter. Agricultural enterprises and peasant households (farmers) that have opted to pay income tax in two stages must pay the second stage totaling 3/4 of the calculated tax amount by December 26. By the same deadline, legal entities are required to submit a Unified Tax Report on Transactions with Affiliated Persons for 2024 (form IUPT24). Employers in the passenger transport sector operating taxis must submit a report and pay income tax, mandatory health insurance contributions, and compulsory state social insurance contributions (form TAXI18) for January 2026. If staff are hired after the relevant report has been submitted, these employers are required to submit an additional report on the day of hiring. A complete list of tax reports and obligations can be found in the tax calendar published on the official website of the State Tax Service: https://sfs.md/ro/calendar. // 10.12.2025 – InfoMarket.